80 · Survey Results: Survey Questions And Responses

The university HDHP PPO &Medical Savings Plan. The plan combines comprehensive medical coverage, a tax-

advantaged savings account, and Health Risk and Biometric Assessment features.

The plans offer lower employee contributions in exchange for a higher annual deductible, coinsurance, and out-of-

pocket maximum. What sets the PCA High PPO and PCA Low PPO apart from your other health plan options is that

each year you receive a lump sum allowance to spend as you choose on health care. Additionally, unused amounts roll

to the next year and are added to new amounts placed in these accounts by the university for your healthcare needs.

You can accrue up to three times the annual university contribution for the plan you select.

The university has 4 self-insured plans to choose from: University High Deductible Plan, University Low Deductible Plan,

University HSA-Eligible Plan, University Co-pay Plan.

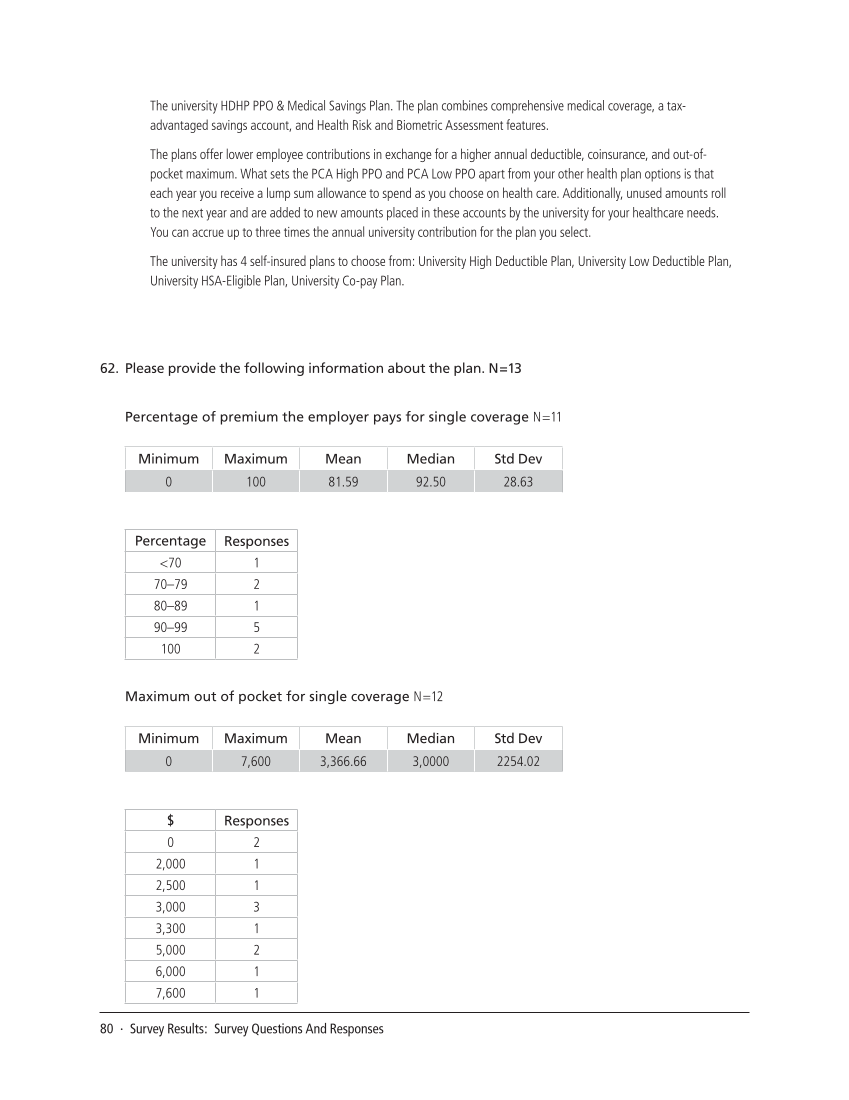

62. Please provide the following information about the plan. N=13

Percentage of premium the employer pays for single coverage N=11

Minimum Maximum Mean Median Std Dev

0 100 81.59 92.50 28.63

Percentage Responses

70 1

70–79 2

80–89 1

90–99 5

100 2

Maximum out of pocket for single coverage N=12

Minimum Maximum Mean Median Std Dev

0 7,600 3,366.66 3,0000 2254.02

$Responses

0 2

2,000 1

2,500 1

3,000 3

3,300 1

5,000 2

6,000 1

7,600 1

The university HDHP PPO &Medical Savings Plan. The plan combines comprehensive medical coverage, a tax-

advantaged savings account, and Health Risk and Biometric Assessment features.

The plans offer lower employee contributions in exchange for a higher annual deductible, coinsurance, and out-of-

pocket maximum. What sets the PCA High PPO and PCA Low PPO apart from your other health plan options is that

each year you receive a lump sum allowance to spend as you choose on health care. Additionally, unused amounts roll

to the next year and are added to new amounts placed in these accounts by the university for your healthcare needs.

You can accrue up to three times the annual university contribution for the plan you select.

The university has 4 self-insured plans to choose from: University High Deductible Plan, University Low Deductible Plan,

University HSA-Eligible Plan, University Co-pay Plan.

62. Please provide the following information about the plan. N=13

Percentage of premium the employer pays for single coverage N=11

Minimum Maximum Mean Median Std Dev

0 100 81.59 92.50 28.63

Percentage Responses

70 1

70–79 2

80–89 1

90–99 5

100 2

Maximum out of pocket for single coverage N=12

Minimum Maximum Mean Median Std Dev

0 7,600 3,366.66 3,0000 2254.02

$Responses

0 2

2,000 1

2,500 1

3,000 3

3,300 1

5,000 2

6,000 1

7,600 1