48 · Survey Results: Survey Questions And Responses

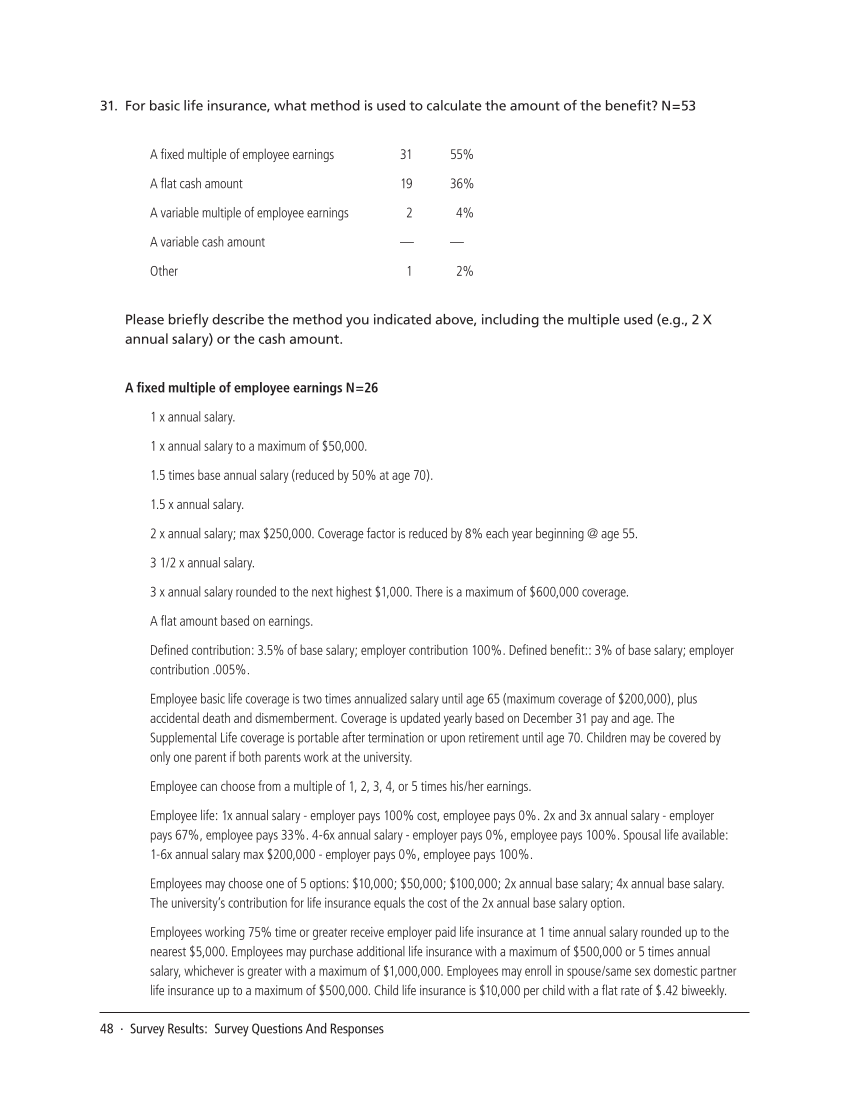

31. For basic life insurance, what method is used to calculate the amount of the benefit? N=53

A fixed multiple of employee earnings 31 55%

A flat cash amount 19 36%

A variable multiple of employee earnings 2 4%

A variable cash amount — —

Other 1 2%

Please briefly describe the method you indicated above, including the multiple used (e.g., 2 X

annual salary) or the cash amount.

A fixed multiple of employee earnings N=26

1 x annual salary.

1 x annual salary to a maximum of $50,000.

1.5 times base annual salary (reduced by 50% at age 70).

1.5 x annual salary.

2 x annual salary max $250,000. Coverage factor is reduced by 8% each year beginning @age 55.

3 1/2 x annual salary.

3 x annual salary rounded to the next highest $1,000. There is a maximum of $600,000 coverage.

A flat amount based on earnings.

Defined contribution: 3.5% of base salary employer contribution 100%. Defined benefit:: 3% of base salary employer

contribution .005%.

Employee basic life coverage is two times annualized salary until age 65 (maximum coverage of $200,000), plus

accidental death and dismemberment. Coverage is updated yearly based on December 31 pay and age. The

Supplemental Life coverage is portable after termination or upon retirement until age 70. Children may be covered by

only one parent if both parents work at the university.

Employee can choose from a multiple of 1, 2, 3, 4, or 5 times his/her earnings.

Employee life: 1x annual salary -employer pays 100% cost, employee pays 0%. 2x and 3x annual salary -employer

pays 67%, employee pays 33%. 4-6x annual salary -employer pays 0%, employee pays 100%. Spousal life available:

1-6x annual salary max $200,000 -employer pays 0%, employee pays 100%.

Employees may choose one of 5 options: $10,000 $50,000 $100,000 2x annual base salary 4x annual base salary.

The university’s contribution for life insurance equals the cost of the 2x annual base salary option.

Employees working 75% time or greater receive employer paid life insurance at 1 time annual salary rounded up to the

nearest $5,000. Employees may purchase additional life insurance with a maximum of $500,000 or 5 times annual

salary, whichever is greater with a maximum of $1,000,000. Employees may enroll in spouse/same sex domestic partner

life insurance up to a maximum of $500,000. Child life insurance is $10,000 per child with a flat rate of $.42 biweekly.

31. For basic life insurance, what method is used to calculate the amount of the benefit? N=53

A fixed multiple of employee earnings 31 55%

A flat cash amount 19 36%

A variable multiple of employee earnings 2 4%

A variable cash amount — —

Other 1 2%

Please briefly describe the method you indicated above, including the multiple used (e.g., 2 X

annual salary) or the cash amount.

A fixed multiple of employee earnings N=26

1 x annual salary.

1 x annual salary to a maximum of $50,000.

1.5 times base annual salary (reduced by 50% at age 70).

1.5 x annual salary.

2 x annual salary max $250,000. Coverage factor is reduced by 8% each year beginning @age 55.

3 1/2 x annual salary.

3 x annual salary rounded to the next highest $1,000. There is a maximum of $600,000 coverage.

A flat amount based on earnings.

Defined contribution: 3.5% of base salary employer contribution 100%. Defined benefit:: 3% of base salary employer

contribution .005%.

Employee basic life coverage is two times annualized salary until age 65 (maximum coverage of $200,000), plus

accidental death and dismemberment. Coverage is updated yearly based on December 31 pay and age. The

Supplemental Life coverage is portable after termination or upon retirement until age 70. Children may be covered by

only one parent if both parents work at the university.

Employee can choose from a multiple of 1, 2, 3, 4, or 5 times his/her earnings.

Employee life: 1x annual salary -employer pays 100% cost, employee pays 0%. 2x and 3x annual salary -employer

pays 67%, employee pays 33%. 4-6x annual salary -employer pays 0%, employee pays 100%. Spousal life available:

1-6x annual salary max $200,000 -employer pays 0%, employee pays 100%.

Employees may choose one of 5 options: $10,000 $50,000 $100,000 2x annual base salary 4x annual base salary.

The university’s contribution for life insurance equals the cost of the 2x annual base salary option.

Employees working 75% time or greater receive employer paid life insurance at 1 time annual salary rounded up to the

nearest $5,000. Employees may purchase additional life insurance with a maximum of $500,000 or 5 times annual

salary, whichever is greater with a maximum of $1,000,000. Employees may enroll in spouse/same sex domestic partner

life insurance up to a maximum of $500,000. Child life insurance is $10,000 per child with a flat rate of $.42 biweekly.