32 · Survey Results: Survey Questions And Responses

salary to your benefit. Service greater than 30.000 is multiplied by 2.5 percent of FAS. The annual benefit may not

exceed 100 percent of final average salary or the limits under Internal Revenue Code Section 415.

Other

Total credited service x graded multiplier x average monthly compensation. The period of your employment during

which you are a member making contributions to the ASRS, plus any service purchased and credited to your account.

Multiplied by a percentage set by statute. It is based on your total years of service at retirement. Multiplied by

Determined by one of two calculation methods: the 36-month or 60-month calculation.

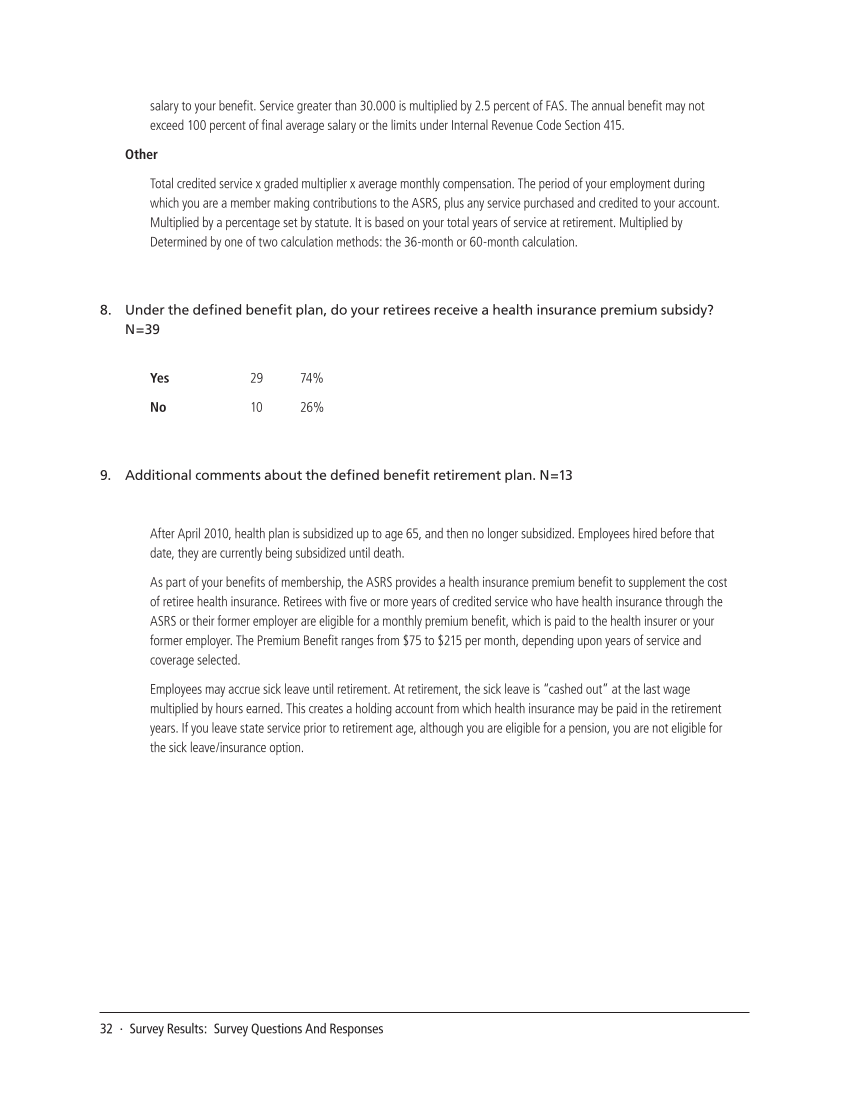

8. Under the defined benefit plan, do your retirees receive a health insurance premium subsidy?

N=39

Yes 29 74%

No 10 26%

9. Additional comments about the defined benefit retirement plan. N=13

After April 2010, health plan is subsidized up to age 65, and then no longer subsidized. Employees hired before that

date, they are currently being subsidized until death.

As part of your benefits of membership, the ASRS provides a health insurance premium benefit to supplement the cost

of retiree health insurance. Retirees with five or more years of credited service who have health insurance through the

ASRS or their former employer are eligible for a monthly premium benefit, which is paid to the health insurer or your

former employer. The Premium Benefit ranges from $75 to $215 per month, depending upon years of service and

coverage selected.

Employees may accrue sick leave until retirement. At retirement, the sick leave is “cashed out” at the last wage

multiplied by hours earned. This creates a holding account from which health insurance may be paid in the retirement

years. If you leave state service prior to retirement age, although you are eligible for a pension, you are not eligible for

the sick leave/insurance option.

salary to your benefit. Service greater than 30.000 is multiplied by 2.5 percent of FAS. The annual benefit may not

exceed 100 percent of final average salary or the limits under Internal Revenue Code Section 415.

Other

Total credited service x graded multiplier x average monthly compensation. The period of your employment during

which you are a member making contributions to the ASRS, plus any service purchased and credited to your account.

Multiplied by a percentage set by statute. It is based on your total years of service at retirement. Multiplied by

Determined by one of two calculation methods: the 36-month or 60-month calculation.

8. Under the defined benefit plan, do your retirees receive a health insurance premium subsidy?

N=39

Yes 29 74%

No 10 26%

9. Additional comments about the defined benefit retirement plan. N=13

After April 2010, health plan is subsidized up to age 65, and then no longer subsidized. Employees hired before that

date, they are currently being subsidized until death.

As part of your benefits of membership, the ASRS provides a health insurance premium benefit to supplement the cost

of retiree health insurance. Retirees with five or more years of credited service who have health insurance through the

ASRS or their former employer are eligible for a monthly premium benefit, which is paid to the health insurer or your

former employer. The Premium Benefit ranges from $75 to $215 per month, depending upon years of service and

coverage selected.

Employees may accrue sick leave until retirement. At retirement, the sick leave is “cashed out” at the last wage

multiplied by hours earned. This creates a holding account from which health insurance may be paid in the retirement

years. If you leave state service prior to retirement age, although you are eligible for a pension, you are not eligible for

the sick leave/insurance option.