SPEC Kit 320: Core Benefits · 29

Tier 3 (hired after 2003) =age 58 with 30 years of service or age 65.

Unreduced benefits when age and years of creditable service total 80 (Rule of 80). Members joining TRS after June 30,

1992, may retire with unreduced benefits when age and years of creditable service total 90 (Rule of 90).

Varies from plan to plan. Some have full eligibility at (age/years) 65/5, or 65/10, or 60/5, 55/25, or any age/+30. Early

retirement options available at 55/20 or 55/10.

You are age 65 with five or more years of service credit OR Your age and years of service credit total 80 and you have at

least five years of service credit. If you first became a member of TRS or returned to membership on or after September

1, 2007, you will meet the age and service requirements for normal-age service retirement when: You are age 65 with

five or more years of service credit or You are at least age 60, and your age and years of service credit total 80, and you

have at least five years of service credit.

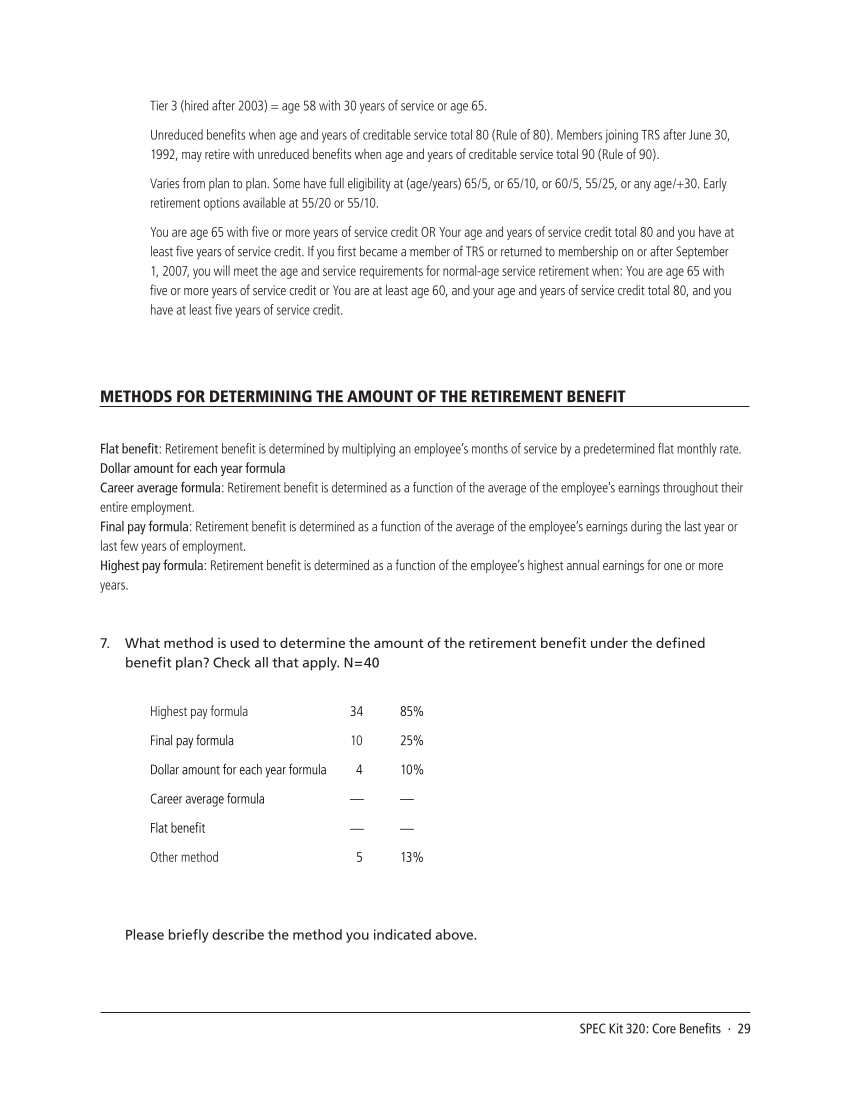

METHODS FOR DETERMINING THE AMOUNT OF THE RETIREMENT BENEFIT

Flat benefit: Retirement benefit is determined by multiplying an employee’s months of service by a predetermined flat monthly rate.

Dollar amount for each year formula

Career average formula: Retirement benefit is determined as a function of the average of the employee’s earnings throughout their

entire employment.

Final pay formula: Retirement benefit is determined as a function of the average of the employee’s earnings during the last year or

last few years of employment.

Highest pay formula: Retirement benefit is determined as a function of the employee’s highest annual earnings for one or more

years.

7. What method is used to determine the amount of the retirement benefit under the defined

benefit plan? Check all that apply. N=40

Highest pay formula 34 85%

Final pay formula 10 25%

Dollar amount for each year formula 4 10%

Career average formula — —

Flat benefit — —

Other method 5 13%

Please briefly describe the method you indicated above.

Tier 3 (hired after 2003) =age 58 with 30 years of service or age 65.

Unreduced benefits when age and years of creditable service total 80 (Rule of 80). Members joining TRS after June 30,

1992, may retire with unreduced benefits when age and years of creditable service total 90 (Rule of 90).

Varies from plan to plan. Some have full eligibility at (age/years) 65/5, or 65/10, or 60/5, 55/25, or any age/+30. Early

retirement options available at 55/20 or 55/10.

You are age 65 with five or more years of service credit OR Your age and years of service credit total 80 and you have at

least five years of service credit. If you first became a member of TRS or returned to membership on or after September

1, 2007, you will meet the age and service requirements for normal-age service retirement when: You are age 65 with

five or more years of service credit or You are at least age 60, and your age and years of service credit total 80, and you

have at least five years of service credit.

METHODS FOR DETERMINING THE AMOUNT OF THE RETIREMENT BENEFIT

Flat benefit: Retirement benefit is determined by multiplying an employee’s months of service by a predetermined flat monthly rate.

Dollar amount for each year formula

Career average formula: Retirement benefit is determined as a function of the average of the employee’s earnings throughout their

entire employment.

Final pay formula: Retirement benefit is determined as a function of the average of the employee’s earnings during the last year or

last few years of employment.

Highest pay formula: Retirement benefit is determined as a function of the employee’s highest annual earnings for one or more

years.

7. What method is used to determine the amount of the retirement benefit under the defined

benefit plan? Check all that apply. N=40

Highest pay formula 34 85%

Final pay formula 10 25%

Dollar amount for each year formula 4 10%

Career average formula — —

Flat benefit — —

Other method 5 13%

Please briefly describe the method you indicated above.