SPEC Kit 320: Core Benefits · 25

offered with a variety of employer contributions, please answer the questions below based on the

plan with the highest employer contribution percentage.

If you answered No, please skip to the Retirement Plans: Defined Contribution section of the

survey.

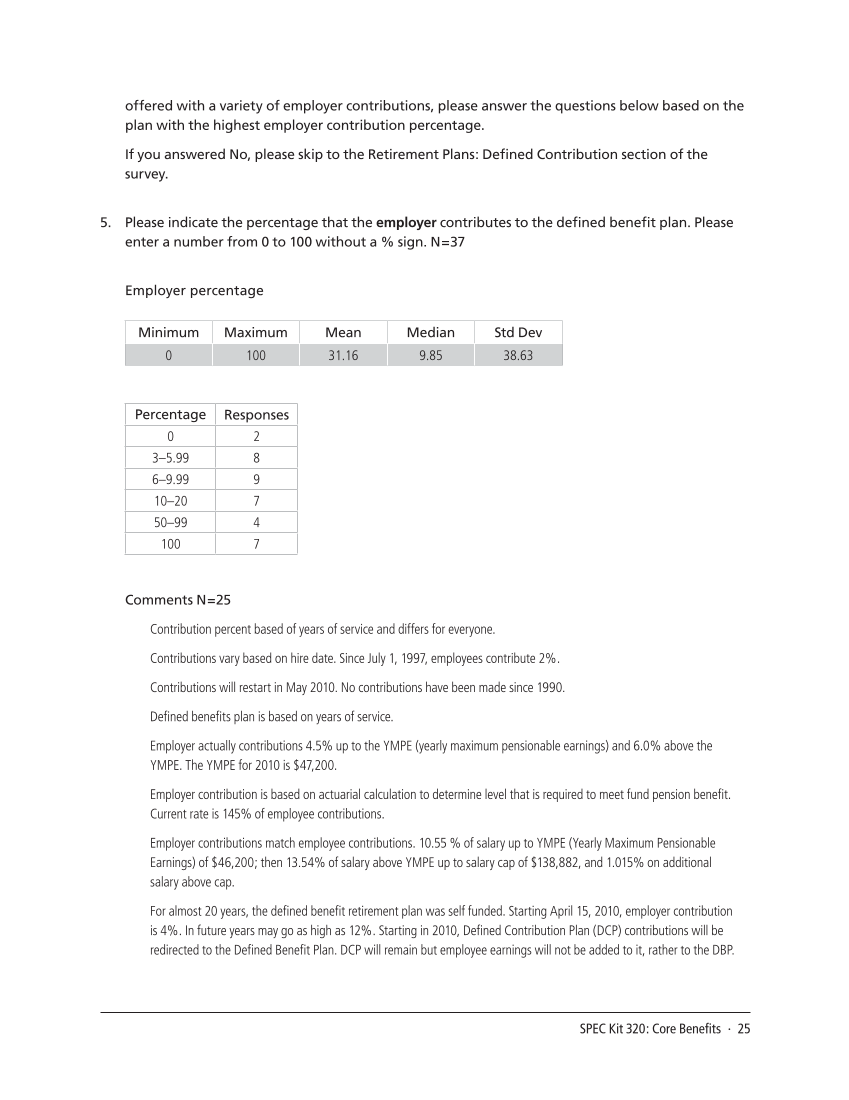

5. Please indicate the percentage that the employer contributes to the defined benefit plan. Please

enter a number from 0 to 100 without a %sign. N=37

Employer percentage

Minimum Maximum Mean Median Std Dev

0 100 31.16 9.85 38.63

Percentage Responses

0 2

3–5.99 8

6–9.99 9

10–20 7

50–99 4

100 7

Comments N=25

Contribution percent based of years of service and differs for everyone.

Contributions vary based on hire date. Since July 1, 1997, employees contribute 2%.

Contributions will restart in May 2010. No contributions have been made since 1990.

Defined benefits plan is based on years of service.

Employer actually contributions 4.5% up to the YMPE (yearly maximum pensionable earnings) and 6.0% above the

YMPE. The YMPE for 2010 is $47,200.

Employer contribution is based on actuarial calculation to determine level that is required to meet fund pension benefit.

Current rate is 145% of employee contributions.

Employer contributions match employee contributions. 10.55 %of salary up to YMPE (Yearly Maximum Pensionable

Earnings) of $46,200 then 13.54% of salary above YMPE up to salary cap of $138,882, and 1.015% on additional

salary above cap.

For almost 20 years, the defined benefit retirement plan was self funded. Starting April 15, 2010, employer contribution

is 4%. In future years may go as high as 12%. Starting in 2010, Defined Contribution Plan (DCP) contributions will be

redirected to the Defined Benefit Plan. DCP will remain but employee earnings will not be added to it, rather to the DBP.

offered with a variety of employer contributions, please answer the questions below based on the

plan with the highest employer contribution percentage.

If you answered No, please skip to the Retirement Plans: Defined Contribution section of the

survey.

5. Please indicate the percentage that the employer contributes to the defined benefit plan. Please

enter a number from 0 to 100 without a %sign. N=37

Employer percentage

Minimum Maximum Mean Median Std Dev

0 100 31.16 9.85 38.63

Percentage Responses

0 2

3–5.99 8

6–9.99 9

10–20 7

50–99 4

100 7

Comments N=25

Contribution percent based of years of service and differs for everyone.

Contributions vary based on hire date. Since July 1, 1997, employees contribute 2%.

Contributions will restart in May 2010. No contributions have been made since 1990.

Defined benefits plan is based on years of service.

Employer actually contributions 4.5% up to the YMPE (yearly maximum pensionable earnings) and 6.0% above the

YMPE. The YMPE for 2010 is $47,200.

Employer contribution is based on actuarial calculation to determine level that is required to meet fund pension benefit.

Current rate is 145% of employee contributions.

Employer contributions match employee contributions. 10.55 %of salary up to YMPE (Yearly Maximum Pensionable

Earnings) of $46,200 then 13.54% of salary above YMPE up to salary cap of $138,882, and 1.015% on additional

salary above cap.

For almost 20 years, the defined benefit retirement plan was self funded. Starting April 15, 2010, employer contribution

is 4%. In future years may go as high as 12%. Starting in 2010, Defined Contribution Plan (DCP) contributions will be

redirected to the Defined Benefit Plan. DCP will remain but employee earnings will not be added to it, rather to the DBP.